The news came to light at the end of August that in the summer period of 2024 there were almost three times as many days when the production of the Paks Nuclear Power Plant had to be reduced, presumably due to adaptation to massive solar power plant production, than a year earlier. Backloading is mainly necessary to prevent breakdowns caused by overproduction and negative price situations when there is no way to export or store the surplus. It must be avoided that the electricity producer pays the electricity user, or that there is a national blackout.

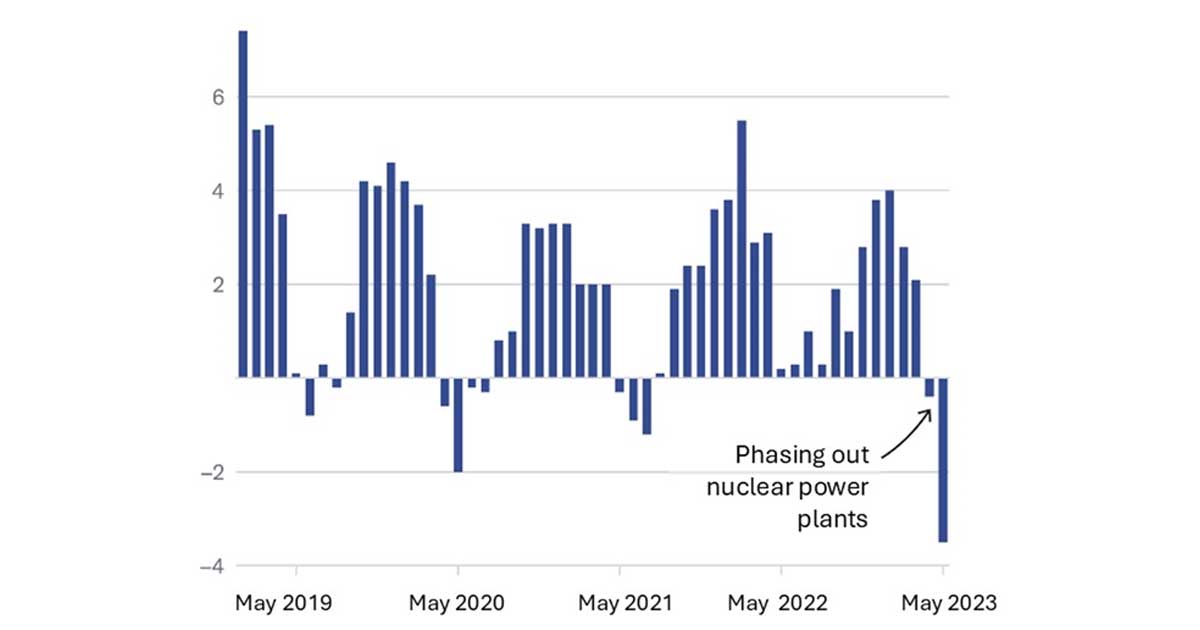

It is not by chance that Hungary builds its climate neutrality plans on solar and nuclear energy, since both electricity generation technologies are decarbonized and best suited to our natural endowments, i.e. thanks to our good solar energy potential and to the situation that nuclear fuel elements that can be stored for years making nuclear energy a domestic source from the point of view of security of supply. Thus, based on our domestic decarbonized electricity production, we can be more crisis-resilient, we can stay out of the struggle for energy sources, increasing our sovereignty. Figure 1 demonstrates exactly this situation on the example of Germany. How export capacity decreased and electricity import peaks increased as a result of the gradual shutdown of their nuclear power plants.

Figure 1 – The development of the German monthly electricity export-import balance in parallel with the capacity increase of weather-dependent renewable generation and the shutdown of nuclear power plants. While the average export potential decreased (from 5.375 TWh/month to 2.50 TWh/month), electricity import peaks increased more than fivefold in the last four years compared to May 2019 (from 0.7 TWh/month to 3.8 TWh/month to). Source: energy-charts.info/Entso-E

Figure 1 – The development of the German monthly electricity export-import balance in parallel with the capacity increase of weather-dependent renewable generation and the shutdown of nuclear power plants. While the average export potential decreased (from 5.375 TWh/month to 2.50 TWh/month), electricity import peaks increased more than fivefold in the last four years compared to May 2019 (from 0.7 TWh/month to 3.8 TWh/month to). Source: energy-charts.info/Entso-E

In this situation, it is particularly problematic that due to one decarbonized power generation sector (solar power plants), another (nuclear power plant) has to be downregulated, moreover, the cheaper one and the one for which none of this is technically good. There is no doubt that in order to ensure the harmonious operation of the Hungarian electricity system, we must find a solution to the above as soon as possible.

Negative electricity prices are slowly becoming the norm in markets dominated by solar and wind power plants

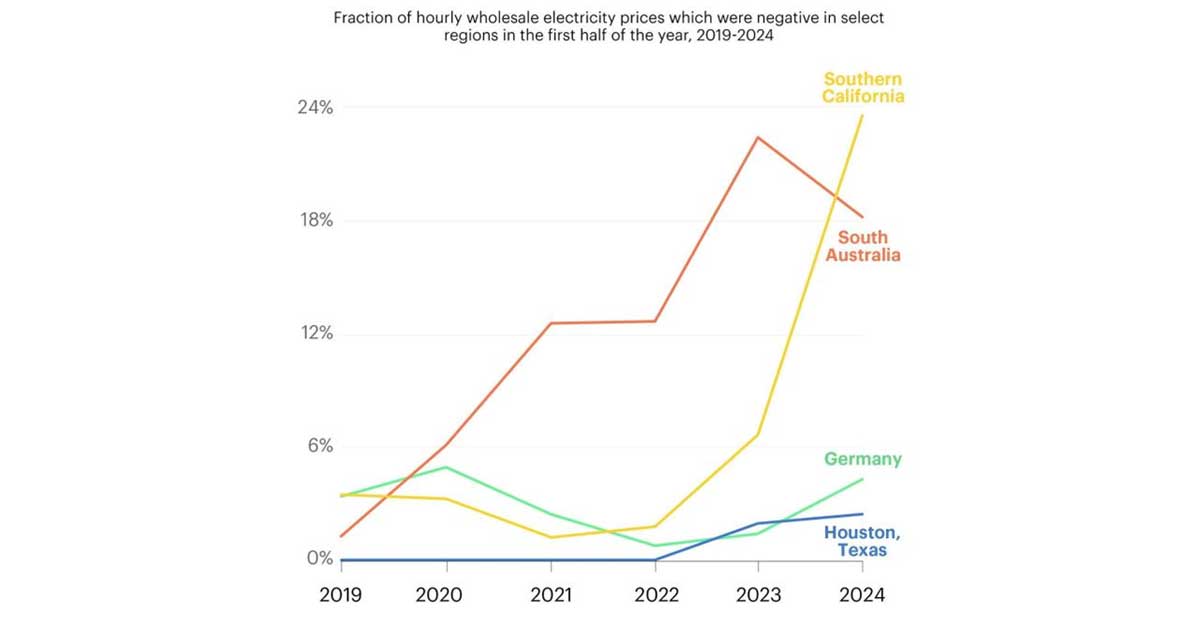

According to the 2024 data of the International Energy Agency (IEA, Electricity Mid-Year Update July 2024, https://iea.li/3Ai9HVg), the frequency of negative wholesale electricity prices has increased significantly in those regions of the world where weather-dependent wind and solar power generation have a high share in the electricity production mix. For example, 20% of the days of the year (73 days) in South Australia, and more than 5% (18 days) in Southern California and Texas are already negative price periods. But Europe, especially Germany, is also catching up. Here, on 20% of the days of the year - i.e. for 73 days - negative price periods of at least 1 hour occur.

What is a negative price? As we mentioned, supply and demand in the electricity markets must be constantly balanced, most of the time with limited storage capacity. If, at the same time, there is insufficient flexibility on the demand side (there is no planned consumption based on consumer groups), this can lead to situations where the electricity producer is willing to pay the customer to take electricity. And it does this because it still suffers less damage than if it shuts down the power plant or disconnects its wind or solar power plant from the grid. In addition, the limited capacity of cross-border electricity networks can aggravate the problems. The export and import of surplus electricity may become impossible due to network congestion or limited availability, which may aggravate symptoms related to negative prices.

It is a fact that the negative price is, in a certain sense, an important market signal, an indicator of the need to reduce production and increase electricity storage. But as long as solar and wind power plants operating at subsidized prices and prioritized power takeover have an easier time getting through these periods of negative prices, the liquidity of the traditional power plant sector operating on a pure market basis is constantly destroyed by these periods. It is interesting that in general, everyone believes that older traditional power plants operate inflexibly, but the production of rooftop solar modules and older wind turbines cannot be reduced either, so they do not respond to price signals. Regulated natural gas and coal-fired power plants respond the most to them, thus making themselves the losers of the new era.

The proportion of negative price periods is not constant, but increases in proportion to the weather-dependent power generation (Figure 2).

The rate of negatively priced hours in the first half of 2024 was over 20% in Southern California, which more than tripled from 7% in the first half of 2023. In April 2024, wholesale prices in Southern California and the Texas Panhandle were negative 40% of the time. In South Australia, the figure was 18%. In these regions, it is now much more common to have negative price intervals within a day than to have an entire day with only positive prices. South Australia is paying not only to import electricity, but also to export it.

But the situation in Europe is not very happy either. Here too, records for the maximum duration of negative price events were broken in 16 countries, including Sweden, Finland, Estonia, Latvia, Lithuania, the Netherlands, Poland, Slovenia and Norway. It happened for the first time in Spain this year, and it can be observed more and more often in Hungary as well. In the year 2023, the length of the negative price period for us was 74 hours, according to Portfolio's calculations, by the end of September 2024, we had already reached 187 hours. If we include not only the negative, but also the nearly zero-priced hours, this year we are already at 327 hours, which is 2.6 times the 127 hours last year.

Figure 2 - Changes in the probability of negative price events between 2019 and 2024 in some regions with high solar and wind power capacity. Source: IEA, Electricity Mid-Year Update 2024, figure: Climate Policy Institute

To avoid negative price periods, there is something to be done at home as well

The target numbers of the EU and our domestic energy and climate policy commitments, the path of technological implementation, and its time schedule are detailed in the National Energy and Climate Plan (NEKT), which is under review. According to this, renewable electricity generation will continue to focus on the expansion of solar power (PV) generation in the future. There are three reasons for this: our climatic conditions are suitable for this, solar power plants do not have fuel costs, and the production costs could be competitive on a market basis almost without subsidies. For the time being, however, these prices are subsidized, based on the EU mandatory feed-in tariff for renewable electricity production (KÁT). While the Paks Nuclear Power Plant produces 1 kWh of electricity for HUF 12-13, a solar power plant receives a subsidy of HUF 47. On average, this exceeds the market price by HUF 25 between January and May. So building a solar power plant under the scope of the KÁT regulation was not a bad deal. It is true that in the meantime there have been a few METÁR tenders with lower subsidies, but the vast majority of solar power plants operating today belong to the KÁT circle. Thanks to this, the installed capacity of the solar power plants and residential solar parks (PV) from 340 MW in 2018 is now slowly reaching 7,000 MW (a twenty-fold increase), which according to the revised NEKT will be around 12,000 MW by 2030.

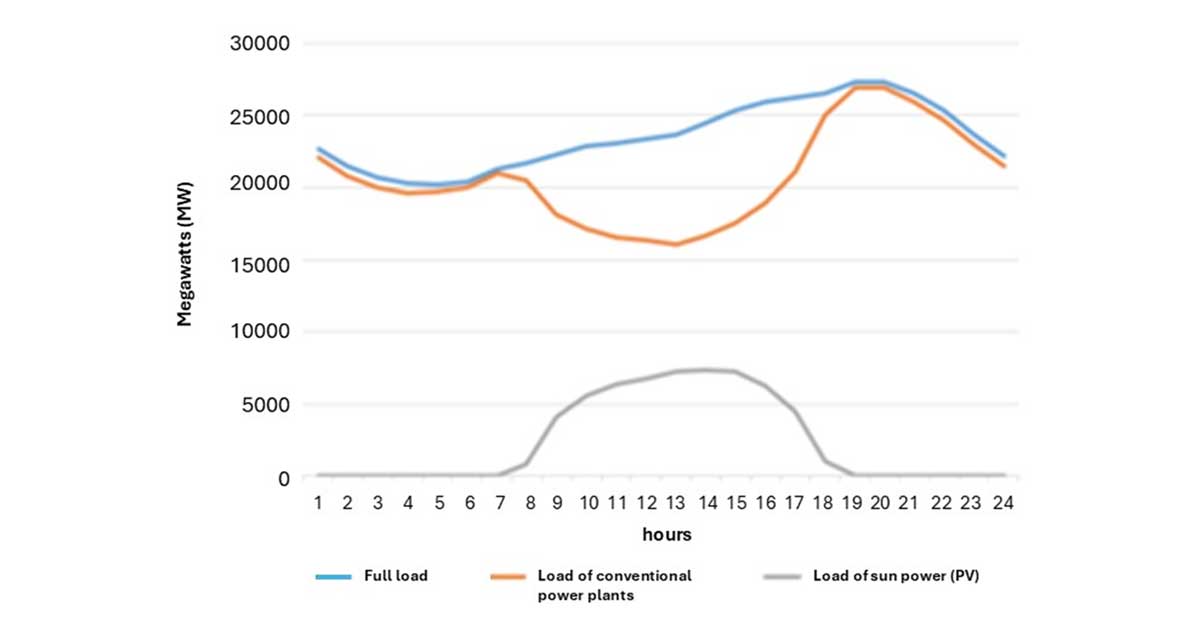

Growth is also expected in the wind power sector according to the revised NEKT, although the installed capacity will not increase as much as in the case of PV. It will increase from the current 330 MW to 1,000 MW by 2030, 2,000 MW by 2040, and 3,000 MW by 2050. If we add to this the output of our traditional (nuclear, gas, biomass/waste) power plants expected to be still in operation at the beginning of the 2030s, which is expected to be nearly 8,000 MW, then we get that 21,000 MW of installed capacity will be opposed to 8,600 - against a daily peak consumption estimated at 9,300 MW. It can be seen that if the 13,000 MW weather-dependent solar and wind power plant operates at close to maximum performance in favorable meteorological conditions, it alone will be able to produce one and a half times our daily peak demand. In the rhythm of daily electricity consumption, the so-called "duck curve" character became typical, i.e. the morning peak disappears due to the rapid rise of solar power generation, and a very strong increase in demand appears at sunset due to the rapid decrease in solar power generation and the increase in consumption with lighting (Figure 3).

Figure 3 - The typical "duck curve" is formed in such a way that the typical time-distributed daily electricity production of the solar panels does not appear in the total production, the system controller cannot predict it at the moment, it can only be quantified afterwards. Source: Duck curve - Wikipedia, figure: Climate Policy Institute

In this situation, in accordance with the KÁT regulation, the production of solar power plants is given priority and the production of the Paks Nuclear Power Plant, and later the Paks-2 Nuclear Power Plant, which will be commissioned in the early 2030s, together with our natural gas-fired power plants, must be adapted to this. The problem with this is that the Paks Nuclear Power Plant is a basic-load power plant, designed to produce cord-hour electricity. It is economical to produce string electricity with the lowest cost, constantly available power plants, with high utilization. This is the guarantee of adequate security of supply and at the same time affordable electricity supply. If the string generators cannot operate at maximum utilization, this alone can result in an increase in the price of electricity. And the backloads are not that they are not favorable to the technical condition of the power plant, but they pose a risk to the feasibility of the planned second operating time extension cycle. The good news is that Paks-2 will be more flexible and will be able to operate according to a schedule.

Since electricity production and import together must equal consumption at all times, a further increase in domestic weather-dependent electricity production cannot be imagined without a substantial increase in balancing and storage capacities. Let's not forget that planned energy management was created by the need to meet consumption in a predictable way. That is why the projects to increase the flexibility of the Hungarian electricity system were started. That is why three modern combined-cycle natural gas-fired power plant blocks suitable for balancing are being built in the area of the Mátrai and Tisza II Power Plants, and one or two pumped-hydropower plants suitable for storage in Borsod and/or at the site of the Mátrai Power Plant. That's why industrial battery cells will be built, which can be used to store a significant amount of electricity in a decarbonized manner. This is also the purpose of the Napenergia+ tenders, opening up the possibility of storing the surplus of solar power production in the backyard with batteries. Just don't run out of time! We are in the 24th hour. Since the traditional power plant sector is also needed in the longer term in addition to renewable electricity production, they must also be provided with the possibility of long-term planning in order to maintain security of supply in the future.