I have already written extensively about how the Russia-Ukraine war has significantly altered gas transit routes. After the outbreak of the war, the European Union saw an opportunity for decoupling by connecting to a fully globalized supply system, with a worldwide network of liquefaction plants, tanks and ports of call rather than fixed routes. Europe has sought to achieve the much-touted diversification, i.e. the expansion of its supply base, by attracting natural gas shipments from further afield, including the United States, Qatar, and even Nigeria. This has led to an unprecedented appetite for liquefied natural gas (LNG) on the old continent.

Although Qatar had already been a major player on the natural gas market prior to the war, its revenues from the production of natural gas began rising dramatically after the outbreak of the conflict. Last April, for example, Qatar even outperformed the United States in terms of gas revenue. Over the past two years, ongoing events gave the Arab country a clear signal that further reinforcing its position in this area will pay off. In previous years, Qatar exported around 100-110 billion cubic metres (bcm) of natural gas, accounting for a fifth of the global LNG market in 2021. Since the outbreak of the war, a growing share of this volume has been arriving to the European Union.

In 2021, the EU imported a total of 77 bcm of LNG. Of this total amount, 22.3 bcm was supplied by the United States; Qatar was the second-largest supplier with 18.5 bcm, just ahead of Russia (15.9 bcm). On the whole, the U.S. supplied almost a third of all LNG shipments, while Qatar and Russia contributed a fifth each of the total.

The year 2022 saw further developments to this picture. LNG imports almost doubled to 135 bcm, with the U.S. supplying 42 percent of this volume, followed by Russia (16 percent) and Qatar (14 percent).

To some, this might suggest that Qatar’s sole in natural gas supplies has somewhat diminished. If we look at countries’ LNG exports to Europe in nominal terms, however, it can be seen that all have increased volumes: the U.S. to 56.4 bcm (up 152 percent year-on-year), Russia to 22 bcm (up 34 percent year-on-year) and Qatar to 19 bcm (up 19.5 percent year-on-year).

Qatar is seeking to secure long-term business opportunities. In November 2022, the country reached an agreement on a 15-year gas supply contract with Germany, and a 27-year deal was signed with China. The exporting country requires such assurances to pump money into boosting its export potential.

At the invitation of his Qatari counterpart, Prime Minister Viktor Orbán also paid a visit to the Arab country, where he attended the World Economic Forum. Speaking at the event, the Hungarian Prime Minister announced that his country will follow suit in buying gas from Qatar. Based on circumstances as they are currently know, the deal is likely to be a long-term agreement under which Hungary will receive the first significant shipments within two to three years, through the LNG terminal on the island of Krk, Croatia.

If the European Union will continue to pursue its diversification agenda, maintaining good relations with Qatar would be beneficial. Not only is the country’s export potential significant at present, but there are further plans to expand capacity to around 150-160 bcm by 2025 and 170-180 bcm per year by 2027 from the current level of around 110 bcm.

In short: it won’t work without Qatar.

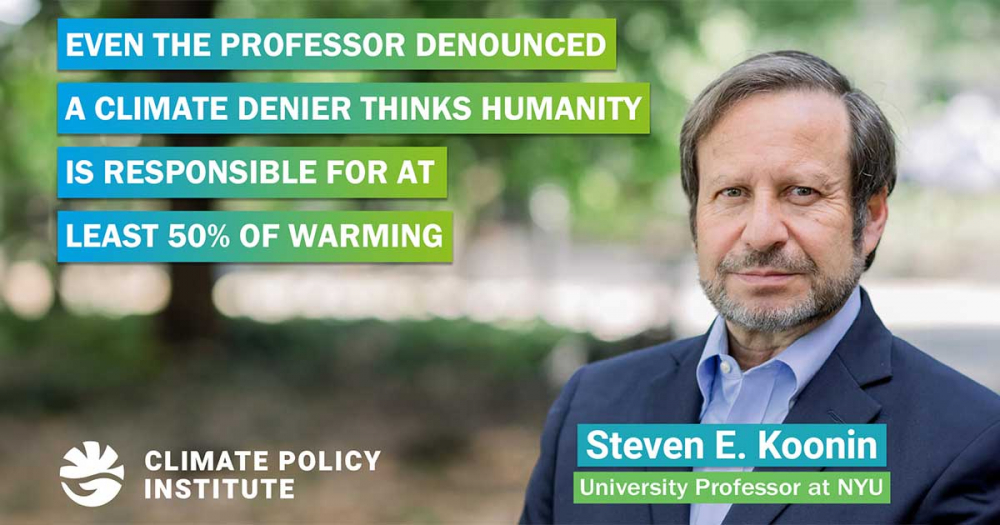

Máté Litkei, Director of the Climate Policy Institute, was on air on M1’s Ma este. Watch the interview in full here.